Mutual Fund SIP Portfolio for Wealth Creation- Detailed Process

Creating a portfolio of top performing mutual fund SIP portfolio requires skills and strategies. To design a portfolio to meet the end objectives require step by step process for consistent returns. Therefore, we have tried to bring multi-point strategy to create a close to ideal mutual fund SIP portfolio after the new SEBI guidelines. Before initiating step by step guide to creating a winning mutual fund SIP portfolio, an investor must know the answer to the question. Why a mutual fund SIP portfolio is needed for long-term wealth creation?

Various Benefits of Equity Mutual Fund SIP Portfolio in Long Term

Mutual Fund SIP Portfolio vs other Investment Avenues like real estate, gold, FD, Debt, bonds, PPF, and traditional products etc.

Mutual fund SIP portfolio is the best source of investment for everyone. An investment is considered good or bad after considering various aspects. The Systematic investment plan scores over all other investment products on the below-mentioned counts. Here are the benefits

- Superior Returns over, medium and long-term. (mean, median, historical returns)

- Extremely Low Expenses incurred at the time of purchase and sales of the investment

- Easy and fast Liquidity scenario of the investment product as easy to buy and quick to redeem

- Better Post-tax returns and Better real rate of returns thus beating inflation

- The minimum amount needed for investments. One can start with as low as 500 Rs per month

- Ease of investments and others. Just by using Pan card, Bank Account and Demat Account only.

- Loan against existing mutual funds sip portfolio can be availed by the holdings. All the open-ended mutual funds shall be blocked by the company and u will get 50% amount as the loan of the market value of securities.

- Ability to play domestic growth, global growth, commodity play, gold play, and even currency play by mutual funds.

- Can do systematic transfers called STP(Systematic Transfer Plan) and can do Systematic Withdrawal Plan called as SWP in the existing mutual fund SIP account.

Once, the person identifies the real benefits of Mutal Fund SIP Portfolio. The person can proceed to do the self-analysis of himself/herself in terms of by taking an advice from a financial planner.

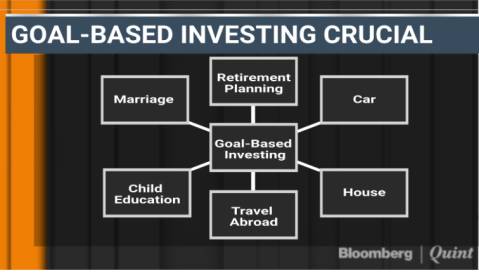

a) Identification of Goals b) Risk Appetite of Investor c) Time horizon of goals and investment d) Amount available for investment

After completion of self-analysis, the following points should be considered to get a superior and consistent risk-adjusted returns in Mutual fund SIP Portfolio. Here is ten step guide to creating a great and top performing mutual fund sip portfolio. The very often asked question and searched question on google is:

How to build a sip portfolio for mutual funds? What are the ways to pick the best mutual fund sips? Which is the best method to select the top performing mutual fund sip portfolio for long-term term wealth creation? What are the top performing mutual fund schemes in 2018?Suggest steps needed to to get early retirement by doing systematic investment plans?

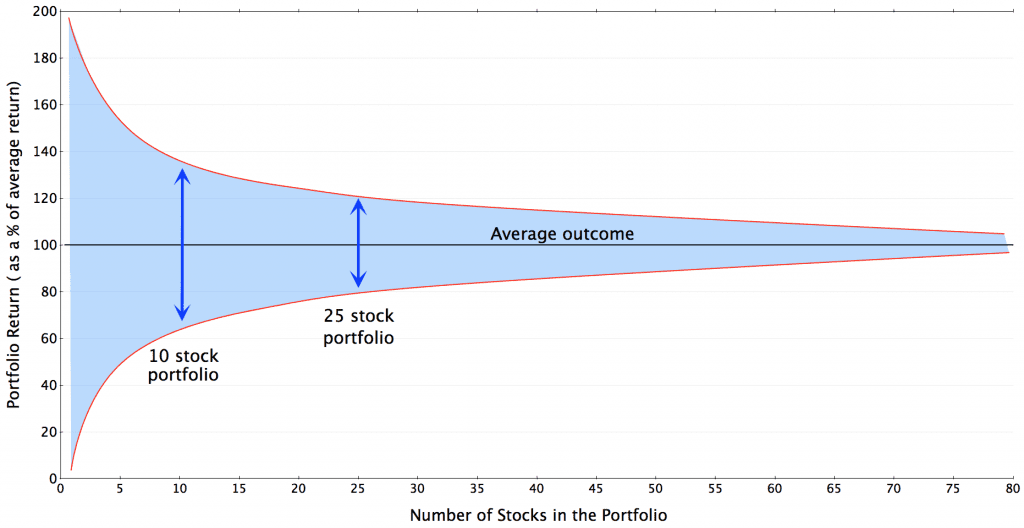

1.Run Concentrated MF Portfolio: Firstly, One should invest in 4-5 schemes at max and should not exceed 5 funds.As it becomes difficult to track and monitor the performance of so many funds. It has been proved that running concentrated portfolios generate superior returns vs over diversified portfolios.

Another advantage is that we can add the 6th product in the portfolio whenever some newer or better product arrives. EX. A person may invest in global funds to capture the global growth and hedge against currency fluctuations. Global funds can be used to diversify across geographies and to play the rise of emerging sectors. Ex. To play the rise of FAANG Stocks(Facebook, Apple, Amazon, Netflix, Google), you may invest in a fund which invests in US equities. This is the rationale for running a concentrated basket so that we can add whenever the need arrives.

2. Diversify AMC and Fund Manager Risk: Secondly, while selecting mutual funds, we must make sure that we select 3-5 different asset management companies. This helps us to ensure that we are getting opinions, strategy, and research from different companies. Hence we are not exposed to specific Asset Management Company risk and a particular fund manager risk. It is often seen that when a particular fund manager leaves a scheme, As a result, the returns start to deviate from historical or mean returns of that scheme. Though it’s not necessary to have 5 different AMC for 5 funds, it is always advised to diversify across AMC. Mahesh Patil of Aditya Birla Sunlife Frontline Equity Fund and Prashant Jain of HDFC Top 100 are some of the star fund managers.

3. Select dates well to average units in SIP: Thirdly, while selecting dates, we should split the amount to be invested in a month into no: of dates. Ex: We want to invest 20k per month and we have selected 4 schemes, then we should have 8 sip dates for an amount of 2500 each. The 8 dates should be different so that we can do averaging across different dates of a month and can ride the volatility in markets in a better and smooth way.

Often people don’t split the amount into parts and don’t select the sip dates apart from one another. Thus they fail to capture the market volatility and swings. It is called better value averaging of SIP units across a month.

4. Assign Goal to Each SIP: The investments should be done regularly, systematically, and should be done for long-term to meet the long-term goals. Most important is to assign particular goals to your sip. Each SIP should have a specific goal, target and time frame in mind.

Ex. A large-cap fund sip which carries lower risk can be used to meet the goals which may come up in next 5 years like buying a car, planning a foreign trip etc. A mid-cap fund carrying a higher risk than large-cap fund can be used to buy the House after 10-15 years. A small cap fund based Sip can be used to plan child higher education after 18-21 years. This risk can be mitigated by increasing the tenure of investments. Refer to our posts on the risk profile associated with the mutual funds

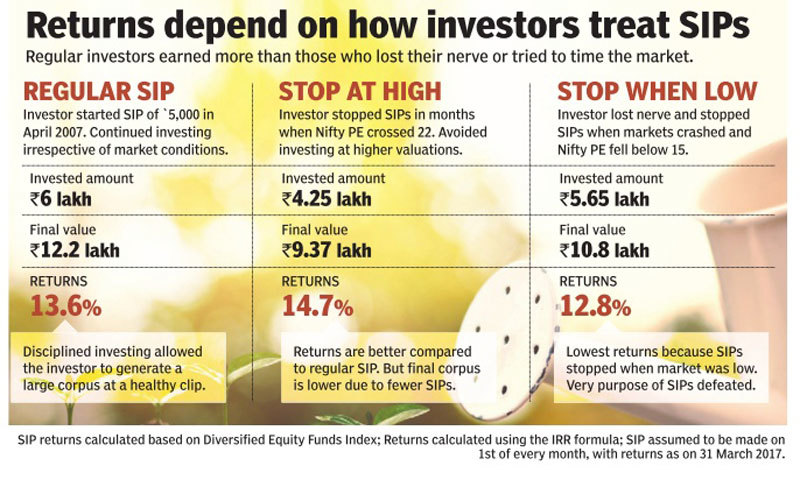

5. Topping up of SIPs in Corrections: Another important step can be a topping of existing sips by investing in a lump some mode by putting surplus funds available with us. The lump sum amount should be invested in seeing the market cycle with advice from a financial advisor. Consequently, u will magnify the returns of your mutual fund SIP portfolio by the huge amount.

Ex. We can top up our small-cap and mid-cap fund sips in 2018 after the carnage in small and mid-cap stocks. This top-up has great benefits and can really help you to achieve your goals. The investments done in times of panic and fear can really compound your wealth significantly. This topping up will have a multiplier effect on your returns.

6. Assigning Weights to Mutual Fund SIPS: We can also assign different weights to various schemes and can invest unequal proportions in a month rather than investing equally across all schemes.Ex. A 22-year-old person decides to invest 20 k /month across a large-cap fund, mid-cap fund, small-cap fund, and multi-cap fund. Assuming that he will marry at the age of 27 and will have children at age of 28-31 and will plan to have a house at age 32-37.

- Dynamic Management of Mutual Fund SIPS: The approximate planning can be done as explained hereinafter. He can invest aggressively into small-cap funds in the initial five years of 22-27. He can invest 8k in small-cap funds and 4k each in remaining 3 funds. Then, he can invest aggressively into mid-cap funds in the age of 27-32. Then in the age profile of 32-37, he can invest aggressively into multi-cap funds and then after 37, he can increase his exposure in the large-cap fund. This mode is slightly difficult and should be planned with the help of a financial advisor.

One can invest in different ratios and proportions across schemes to get top performance in SIP Portfolio. This is called assigning weights and dynamically managing MF portfolio to play the economic cycle.

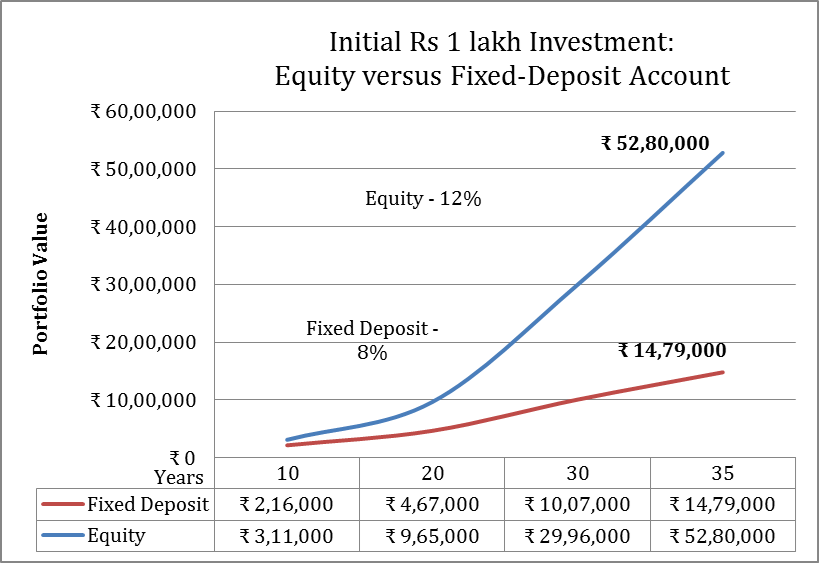

7. Invest for the long term: The best way to create wealth is to invest for really long term ie. 10 years plus. No asset class can beat equities in the long term and this is the only asset class which can beat inflation.

The long-term returns of equities in India are 15% plus CAGR.T his asset class has beaten all the asset classes like real estate, FD, Gold, Bonds, and others. Investments in top performing mutual funds can help us to save the purchasing power of money and our savings. Otherwise, inflation can eat all our savings.

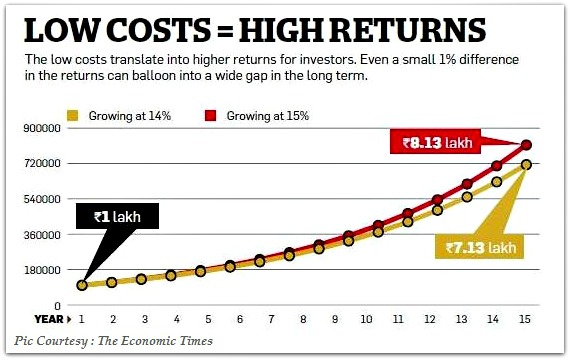

8. Correct Selection of Funds: A 1 percent CAGR difference can have long-term implications in your overall portfolio returns. The funds should be selected with adequate diligence, caution, research, and detailed study. Selecting a fund by looking at past 2 years performance is very risky and unadvised way. Don’t look at just top performing mutual fund schemes from websites to select the funds. This is called a recency bias wherein an investor just gets carried away by the recent superior performance.

- Quantitative Parameters to Select Funds: The funds should be selected on various parameters like risk, return, expense ratio, rolling returns, category average, maximum draw-down, beta, alpha, and various quantitative tools. This example illustrates that 1% CAGR is of huge importance in the long-term. Below is a picture which shows that a 1% CAGR difference can create a huge difference in the long run. The selection should be done by taking advise from a good financial planner. A financial planner may charge you 1 % fees but he will generate superior performance of 3-4 % easily. People hand over their money of 25 lakhs plus to PMS managers, they should hand over their SIP portfolio to an expert as well.

9.Constant Monitoring Once a year: Last but not least, we should monitor our investment once a year to see whether our investments are working in a positive direction to achieve our goals. We should not stick to funds when they start to underperform due to either change in fund manager, wrong fund selection due to us, better investment options available to us etc. This is also known as reviewing and rebalancing of mutual fund portfolio.

Also, looking at top 5 mutual funds in a particular category on the website is a very wrong way of choosing funds. Your funds can change only after they don’t deliver the expected performance for more than 2 years. As told by MFS, ” Past Performance is not a guarantee of the future performance.”

10.Selection of top performing Mutual Funds: We have referred to top 6 websites for selecting the top performing mutual funds in India. We have compiled a list of best mutual funds as per your risk appetite in our previous posts.

Must read this -:

We have followed a detailed process to find the top performing mutual funds in India. We have identified the top 5 mutual funds schemes across all categories and across all these 6 portals. After that, We have given a score of plus 1 to a mutual fund when its found in that website. Ex. If a Particular fund features in all the sites, then we give a score of 6. Similarly, If any particular fund is found in only 2 sites, then we give a score of 2.

Thus, we have compiled a sheet of mutual funds which can be called as the top percentile mutual funds. These are mutual funds which feature in most of the websites out of above 6 websites. This way, we have removed any bias and have taken advantage of research of 6 places. Objectivity and detailed research is the backbone of selecting the top performing mutual funds.

Sample Mutual fund SIP Portfolios: We have tried to design a concentrated and diversified mutual fund SIP portfolio for the aggressive risk taker, moderate risk taker, minimal risk taker. All the funds below are diversified funds.

This is for high-risk high return aggressive investors mutual fund sip portfolio:

- One pure large cap fund

- A pure mid-cap fund

- Another pure small-cap fund

- Additionally pure multi-cap fund

- Lastly, tax saving fund ELSS if needed

- One additional product with time

This is for moderate risk and moderate return investors mutual fund sip portfolio:

- Large and mid-cap fund

- Multicap fund

- Focussed equity fund/ value fund

- Lastly, ELSS if needed

- One additional or better product with time

This is for an investor with minimal risk appetite mutual fund sip portfolio:

- Pure large-cap fund

- Multi-Cap fund

- Value fund

- ELSS if needed

- Another product with time

Usually I don’t read post on blogs, but I would like to say that this write-up very forced me to try and do it! Your writing style has been surprised me. Thanks, quite nice post.