Equity Mutual Funds Divided Into 11 Sub Categories

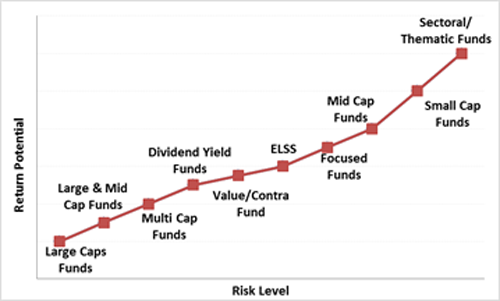

The equity mutual funds have been further divided into following 11 sub-categories by SEBI i.e. large-cap fund, large & mid-cap fund, mid-cap fund, a small-cap fund, multi-cap fund, dividend yield fund, value fund, contra fund, focused fund, sectoral/thematic fund, and ELSS.

- Large-cap funds -: As the name suggests, large-cap equity mutual funds schemes will invest at least 80 percent of their assets in large-sized companies. This scheme provides better risk-adjusted returns when compared to mid and smallcap schemes. Therefore these are the best equity funds for risk-averse investors. Axis Bluechip Fund – D (G), HDFC Top 100 Fund Growth, ICICI Prudential Bluechip Fund Growth, and Reliance Large Cap Fund – Growth is some of the top performing schemes for mutual fund sip in large-cap category.

- Large and Mid Cap Funds -: These equity mutual funds schemes will invest a minimum 35 percent in large-cap stocks and 35 percent in mid-cap stocks. Therefore, these schemes are slightly riskier than large-cap schemes but can provide higher returns as well. Invesco India Growth Opportunities Fund, Canara Robeco Emerging Equities Fund-Regular Plan, Mirae Emerging Bluechip -Direct (G), and Sundaram large and midcap fund are some of the top-performing mutual fund schemes in a large and mid-cap category.

- Mid Cap Funds -: Not much has changed in this equity mutual funds category as well. The schemes will invest a minimum of 65 percent of their assets in midcap stocks. Since these schemes will bet on mid-sized companies, it posses a slightly little higher risk than pure large-cap funds. On the contrary, these schemes have the capability to provide higher returns than the above two on the higher risk-adjusted parameter. Hence, these should be chosen with risk appetite in mind.DSP Midcap Fund Growth, Edelweiss Mid Cap Fund-Regular Plan, Franklin India Prima Fund Growth, HDFC Mid-Cap Opportunities Fund Growth, Invesco India Midcap – D (G), and L&T Midcap Fund -Direct (G). The mentioned schemes are the top picks which can be used for SIP in mid-cap funds.

- Small Cap Funds -: These equity mutual funds will invest 65 percent of its assets in small-cap stocks. These schemes will invest in small-sized companies which may on may-not become big companies. Hence, these are extremely risky but can provide phenomenal returns too. To mitigate risk in small-cap funds, one should have an investment horizon of 5 years plus. Franklin India Smaller Companies Fund, HDFC Small Cap Fund Growth, L&T Emerging Businesses Fund-DP (G), Reliance Small Cap Fund, SBI Small Cap Fund – D (G) are some of the top 4 performing small cap schemes for SIP investments in India. The below graph shows the risk profile attached in various equity oriented schemes. This clearly tells that small-cap funds are riskiest asset class of equity mutual funds.

- Dividend Yield Funds -: This equity mutual funds will invest a minimum 65 percent of assets in stocks that can provide periodic dividends to investors. This set of funds should not be opted and are least preferred for investments.

- Multicap Funds -: Since there is no major change in the multi-cap equity mutual funds category. These schemes will continue to invest across market capitalizations ie these schemes can invest in large-cap, mid-cap or small-cap stocks. A minimum of 65 percent should be allocated to equities. This scheme has the layers of large-cap, mid-cap, and small-cap stocks. This carries a moderate risk profile as it invests across all the segments of market capitalization curve. Kotak Standard Multicap Fund (G), Mirae Asset India Equity Fund Regular Growth, Motilal Oswal multi-cap 35 funds, Axis Focused 25 Fund, Principal Multi-Cap Growth Fund. The mentioned funds are the preferred and top schemes recommended by mutual fund advisors in India across the multi-cap category.

- Focused Funds -: These equity mutual funds are mandated to invest in a maximum of 30 stocks. The schemes have to mention which market cap it intends to invest. A focussed fund is a fund which runs a very concentrated portfolio of stocks. However, a focussed fund may choose to become focused large-cap fund or focussed multi-cap fund. Axis Focused 25 Fund – Direct (G), ICICI Prudential Focused Equity Fund, SBI Focused Equity Fund Growth, and Sundaram Select Focus Fund Growth. These are the top focused mutual funds in India for the systematic investment plan.

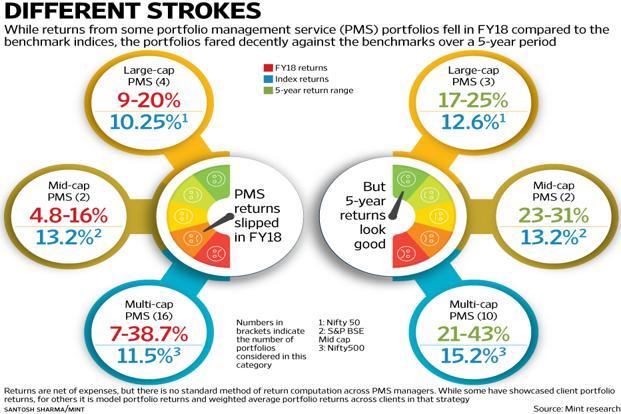

Ex Motilal Oswal Focussed 25 invests in a portfolio of only 25 stocks. The beauty of focussed fund is that it gives the beauty of PMS. The PMS also runs a concentrated portfolio of 15-20 stocks. So a focussed fund is analogous to PMS. Though Portfolio Management Schemes have been able to beat the MF schemes or benchmarks with a huge margin in the past 10 years. The only drawback of a PMS is a minimum ticket size of 25 lakhs which is difficult to afford by everyone.

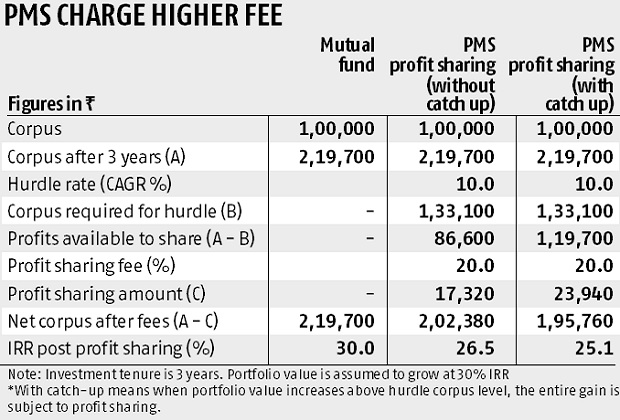

PMS Charge Higher fees vs Mutual Funds: So one can invest in a focussed equity fund as a 5th SIP option after one has already bought 4 funds in his kitty. Though it is generally not recommended because the scheme is skewed towards a very small set of stocks. As the size of the fund increases with time, then it becomes difficult for a fund manager to beat the benchmarks with very few sets of stocks. However, the focussed funds can be a good substitute for PMS. As PMS are complicated products with higher fund management fees. They also charge profit sharing when they cross a minimum threshold returns called as the hurdle rate. Hence, the IRR generated by the equity PMS can beat the IRR generated by the Focussed fund.

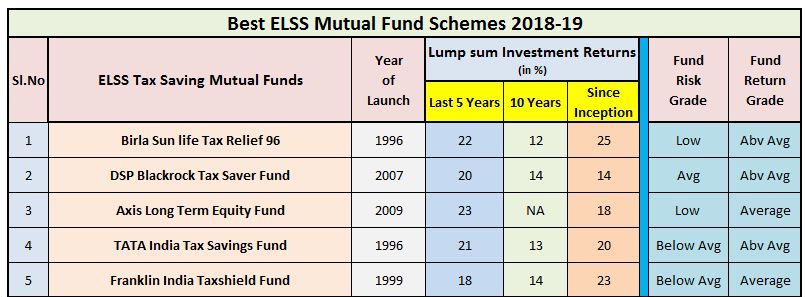

8. Equity Linked Savings Scheme -: The ELSS schemes is a tax saving product and is an equity mutual fund too. However, this has a three-year lock-in period. Any investments made in ELSS attract exemption under section 80 C of income tax act. Any investments can be redeemed after 3 years only. The tax saving should be your peripheral objective and not the core objective. The ELSS Funds offer better post-tax returns than traditional tax saving products. This is a top-notch tax saving instrument in comparison to other traditional products and esp ULIPS. The below chart shows the top 5 mutual fund ELSS schemes in 2018-19.

Cont… Part B.2